Going out of the swamp

Sobratema’s Market Study points to a sales increase of 7.9 percent for 2018, in opposition to a decrease of 15 percent this year

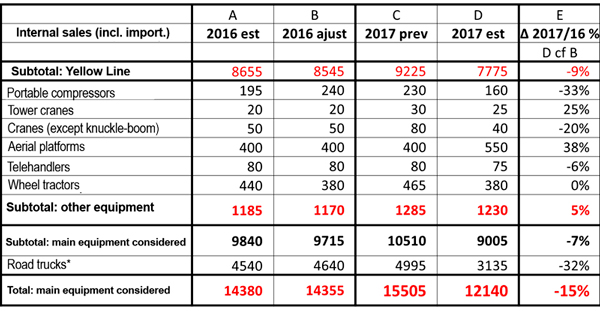

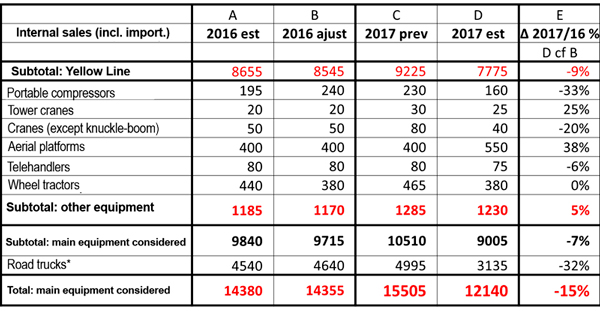

A reduction of 15 percent in the sales of this year that will be half-compensated in the next year with an increase of 7.9 percent. This is the scenario shown by the Sobratema Study of Brazilian Market of Construction Equipment, disclosed during the twelfth edition of the event Tendências, promoted by the M&T Magazine in November 9 at the Espaço Hakka, in São Paulo.

The study projects a retaking with sales increase of 8 percent for the Yellow Line and of 7.3 percent for other categories of equipment, and an increase of 8 percent for road trucks used in construction. Total sales of this year are estimated in 12.1 thousand units, against 14.4 thousand units sold in 2016. And even with this practically negligible result, some relief was brought since it confirms the exit of the swamp.

Since the industry of machines is strictly linked to large infrastructure projects, the study is pointing to a catastrophic scenario of stoppage in works that were going on and to the freezing of investments foreseen for several government plans. Undoubtedly this decrease is due to the stagnation of construction and infrastructure projects caused by the politic and economic crisis.

For example, the Yellow Line—that includes earthmoving equipment—had a sales reduction of 9 percent in 2017, compared to 2016. Loader sales had a reduction of 5 percent while sales of skid-steer loaders were reduced in 9 percent. Sales of mini-excavators were reduced in 32 percent.

The slow recovery that is starting is not causing a considerable increase on machine sales. According to Afonso Mamede, this is happening because the investments in infrastructure have long maturation and depend on government policies. The positive factor is due to the concessions to be carried out, that will bring a new breath of investments in the next year.

He also highlighted that the construction market is becoming different with the entrance of international players in the Brazilian market, the decrease of the role of national groups and the higher participation of medium-size companies. “The construction market will become more diluted”, said him. The vice-president Mário Humberto Marques highlighted the effects of the recent auctions carried out in the area of oil—considered successful—that will be translated in more investments in this industry that will be felt already in 2018.

This bias is already causing changes in the Sobratema Market Study. Some families of machines may show positive results even this year, such as off-road trucks (150%), motor graders (56%), aerial platforms (38%) and tower cranes (25%).

The vice-president Eurimilson Daniel said that the companies are being more conscious and are searching specific niches of work as a way to survive in this moment of stagnant market. And that one of the main consequences of this crisis was due to fleet idleness, which demanded creativity from the companies. In the concrete industry, for example, the reduction was brutal: sales of mixing trucks will decrease 44 percent in 2017, compared to 2016, while concrete plants may increase sales in 15 percent.

The pressman and economist Brian Nicholson, responsible by the data collection and analysis highlights an important point of the research: low-size contractors showed higher capacity to face the crisis, since they have a more dynamic, flexible and actual scope of acting in a more comprehensive market.

Yellow Line, 2016/17

*Estimation – used in construction Obs: Concrete equipment – together with 2018 preview

Av. Francisco Matarazzo, 404 Cj. 701/703 Água Branca - CEP 05001-000 São Paulo/SP

Telefone (11) 3662-4159

© Sobratema. A reprodução do conteúdo total ou parcial é autorizada, desde que citada a fonte. Política de privacidade